Walter Peters – Small Account Big Profits Live Trades

$597.00 Original price was: $597.00.$49.00Current price is: $49.00.

Product Delivery : Instant Deliver

Walter Peters – Small Account Big Profits Live Trades

Sale page: Walter Peters – Small Account Big Profits Live Trades

From the stand-up desk of Walter Peters, PhD.

Sydney, Australia…

If you’ve always wondered if it’s possible to ramp up a small trading account quickly, but wondered exactly how this is done, then this is the most important thing you’ll read today.

I’ll show you why in a minute…

But first, a warning, because most of the “get rich quickly” trading stuff out there is truly a load of crappola.

Forex robots that don’t lose, Ivy League PhD’s sharing their “secret sauce” formula developed with quantum computers…

As you and I know, much of what is out there is balderdash.

And I’ll be the first to admit, what we’re doing here is not for everyone.

Most Traders Never Understand Trade-Level Compounding (and Certainly Don’t Use It)

This is aggressive trading.

This is putting it on the line.

This is compounding at the trade level… something very few traders understand, much less attempt.

But here’s why I believe it’s worth it:

“Some of the world’s greatest feats were accomplished by people not smart enough to know they were impossible.” – Doug Larson

Plenty O’ people will tell you it’s a “pipe dream” or a bad idea to try to make $99,000 over 300 trades (which is exactly what I’m going to try to do, as you’ll see in a minute…)

I think the naysayers are wrong.

Admittedly, I would never trade my only trading stake this way.

It makes sense to break off a little risk capital to trade hyper-aggressively.

The majority of my trading capital grows via “normal compounding” (the slow way)… it only makes sense to do this with a small sub-account.

Because Risk/Reward is the name of the trading game.

Growing an account quickly will ALWAYS have drawbacks.

It is possible to pump up the equity peaks (the lovely parts of your equity curve) without plunging too deep into terrible equity lows…

Higher Rewards Require a Different Type of Risk Management

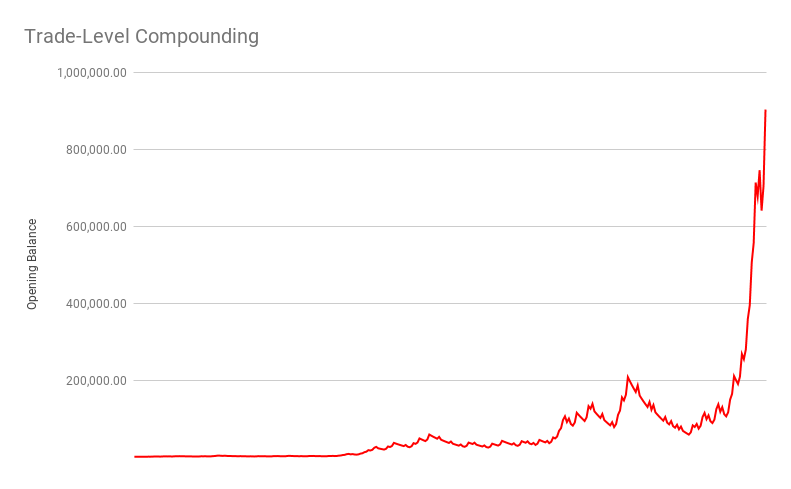

Take a look at the equity curve chart below:

These trades are simulated for a 43% win rate strategy, with a 2:1 reward-to-risk ratio.

The risk per trade is 5%, which is crazy (of course, because every goo-roo trader harps on the “risk 2% per trade”)…

After 322 trades, this puny $1000 account hits $109,622 – which is great.

This is what happens when you trade an o.k. trading system with 5% risk per trade and compound the account.

But the chart below is even more impressive:

In this chart you see the exact same trades, exact same system, but instead of compounding at the account level, this is compounding at the trade level.

This lil ‘ol $1000 account ramps up to $900,000 in this simulation…. even though they are the same trades, the same sequence of winners and losers.

Everything is the same except for the risk management rules.

The Money Is Made During The Losing Streaks

It’s fun to look at the hypothetical equity curves and salivate over the ferraris you can afford once your trading account hits that level….BUT

The reality is most traders give up before they hit the promised land…

Which is too bad.

If you don’t trade through the drawdowns, you’ll never hit the new equity highs.

Which is why trading psychology is a critical component of this course.

To grow an account quickly, you must deal with the losing streaks. These are the silent “trader killers.”

Most traders throw in the towel long before they hit the sweet, sweet equity highs.

Here’s What You’re Getting…

This is different to what you’ve seen before, because there’s no magic system (in fact, you can do this with dozens of different trading systems).

No “holy grail” or the secret harmonics W.D. Gann passed down to his great-grandkids… instead you’ll get what matters.

Week 1: Broker Risk

- How your broker is ripping you off – and exactly what to do about it (HINT: finding the right broker is only half of the solution)

- The unexpected broker solution that may just be the best medicine for traders looking to avoid dodgy brokers or “frozen” trading platforms

- Why this well-respected western country is the *absolute worst* place to look for a broker (even though it’s considered one of the financial centers of the world)

Week 2: The Three Keys

- Discover the method for pumping up your winners, it’s literally the secret of the (very) wealthy, and you can apply it to your trading

- Why some trading rules must be broken in order for you to achieve lofty goals (traders who don’t realize this will never compound accounts quickly)

- How to survive the bad times (HINT: losing streaks stink, it’s what you do after you hit one that matters)

Week 3: You Decide The Risk/Reward

- The Australian “secret” to high reward-to-risk trading (this sounds weird, but it’s true)

- Three steps to compounding an account quickly, even if you’ve never traded profitably before

- The tactic you must master if you want to trade for large gains (and no it’s not simply ‘trade a high risk/reward strategy’)

Week 4: Losing Streaks

- How to learn from losing and why most traders “learn too much” from losing (HINT: it’s also why many traders spin their wheels for years)

- Your trading success depends on how you view losing streaks, here’s a mental trick so you can trade happily through losing streaks

- The weird reason why demo account traders smoke live account traders (you can use this to your advantage once you grasp this)

Week 5: Trading Psychology

- Why your unlucky trades may kick-start your trading and guarantee your long-term trading health (so you can ignore “trading fluff” and focus on what makes moolah)

- The secret ways billionaires use painful life lessons as motivation and fuel for success (every trader needs these tools in his toolchest)

- How to learn the “wise trader” method for literally vaccinating you against the number one “trader killer” nearly all traders who don’t know this will quit trading (but now you will thrive)

Readmore about: Walter Peters

Related products

Instant Delivery

Instant Delivery

Instant Delivery

Instant Delivery

Instant Delivery

Total sold: 1

Instant Delivery

Instant Delivery

Instant Delivery