Bill Wolfe – Wolfe Waves

$3,000.00 Original price was: $3,000.00.$38.00Current price is: $38.00.

Total Sold: 1

Product Delivery : Instant Deliver

Bill Wolfe – Wolfe Waves

Salepage: Bill Wolfe – Wolfe Waves

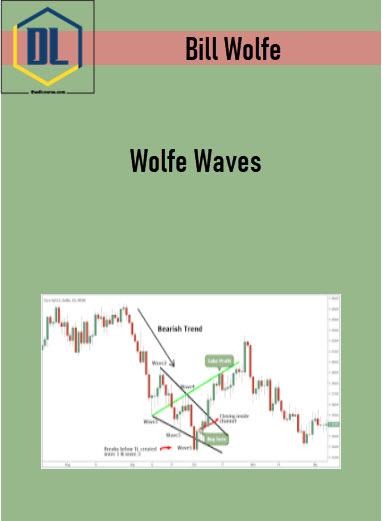

The Wolfe Wave (Not to be confused with The Elliot Wave), discovered by Bill Wolfe, is a naturally occurring, harmonic trading pattern and is generally seen as a reversal pattern. The pattern is made up of five waves (fives distinctive bull & bear movements within a channel) showing supply and demand and the fight between supply and demand towards setting a new price. These patterns can develop over short and long-term time frames such as minutes or weeks and are used to predict where a price will break-out of it’s channel and where price will go after the break. When correctly exploited, Wolfe Waves can be extremely effective.

It’s Reversal Qualities

An upward sloping trending channel will result in a bearish reversal of price and a downward sloping trend channel will result in a bullish reversal of price.

Generally the Wolfe wave can be seen when the price is contained within a channel and can give traders a good idea when the price is going to break-out of the channel and reverse. These channels can be parallel as per our Range and Channel Trading section, or can converge as per Wedge Patterns. Within these channels the Wolfe Wave has an amazing symmetrical pattern, with the wave cycles having equal time intervals between them.

The Wolfe Wave’s Psychology

Bill Wolfe suggests that the wolf wave is a naturally occurring harmonic pattern, found in all financial charts, all of the time. This suggests that there’s no psychology behind it. If you want to get to grips with the psychological mindset of the market, then other technical analysis will have to be utilised. For instance the use of volume, support & resistance and price action may be useful in understanding the market’s psychological state. Of course, Bill Wolfe and his disciples would be against the use of additional indicators, as Wolfe suggests that the Wolfe Wave stands alone in it’s methodology. The choice is yours…

To Sum Up

It is important to note that Wolfe Waves, are highly subjective and may need other technical analysis to figure out the market psychology (although Bill Wolfe, probably wouldn’t agree with the use of further TA). The key to profiting is accurately identifying and exploiting these trends in real time, which can be more difficult than it sounds. As a result, it is wise to trade this technique with a practice account – as it is any new technique you are learning – before going live. And, remember to use stop/loss to limit your losses.

Technical analysis is not an exact science and although these indicators and patterns can increase the probability of making the correct trade, many will go against you and large losses can be incurred. Your own trading strategy needs to be formed and hopefully you’ll be on your way to achieving this on completion of this course.

What you will learn…

There are two parts to successful trading: a) A precise methodology and b) A healthy mental attitude. Once you have them both, you are on your way to success. The Q&A below provide a winning combination. Practical answers that serve to eliminate anxiety.

In addition during the advanced training you will learn…

How to determine the Dominant Wave…How to anticipate the Rhythm of the market…How to zero in on the Sweet Zone…WolfeWave analysis on time frames as small as a tic chart…How everything matters and how it will ultimately have an impact on future price…Scalping…Volume interpretation…The impact of Globex trading on WolfeWaves…Where the 3 point is likely to come in… How to approximate the 4 point in advance… AND…This is all introduced in a timely fashion as you watch S&P WolfeWaves unfold during your 10-days of fax instruction.

Readmore about: Bill Wolfe

Proof:

![Bill Wolfe – Wolfe Waves [Group Buy] 1 Bill Wolfe – Wolfe Waves](https://i2.wp.com/wsolibrary.com/wp-content/uploads/2019/10/capture-28.png?resize=601%2C523&ssl=1)

Related products

Trading Stock - Forex

Instant Delivery

Trading Stock - Forex

Instant Delivery

Total sold: 1

Instant Delivery

Instant Delivery

Trading Stock - Forex

Instant Delivery